Position Rollovers

Position Rollovers allow operators to maintain operational continuity without triggering bounded liquidation. They provide a controlled method to refinance temporary deficits by using unused credit lines or re-allocating backing assets — which can improve the Health Factor (HF), maintaining the stability of delegated YODL.

Mechanism

Deficit Detection

The HF is viewable on the operator dashboard, and as it approaches 1.0, it indicates a potential deficit based on mark-to-market asset values and applied haircuts. The operator may elect to perform a rollover before liquidation triggers.

Credit Re-allocation

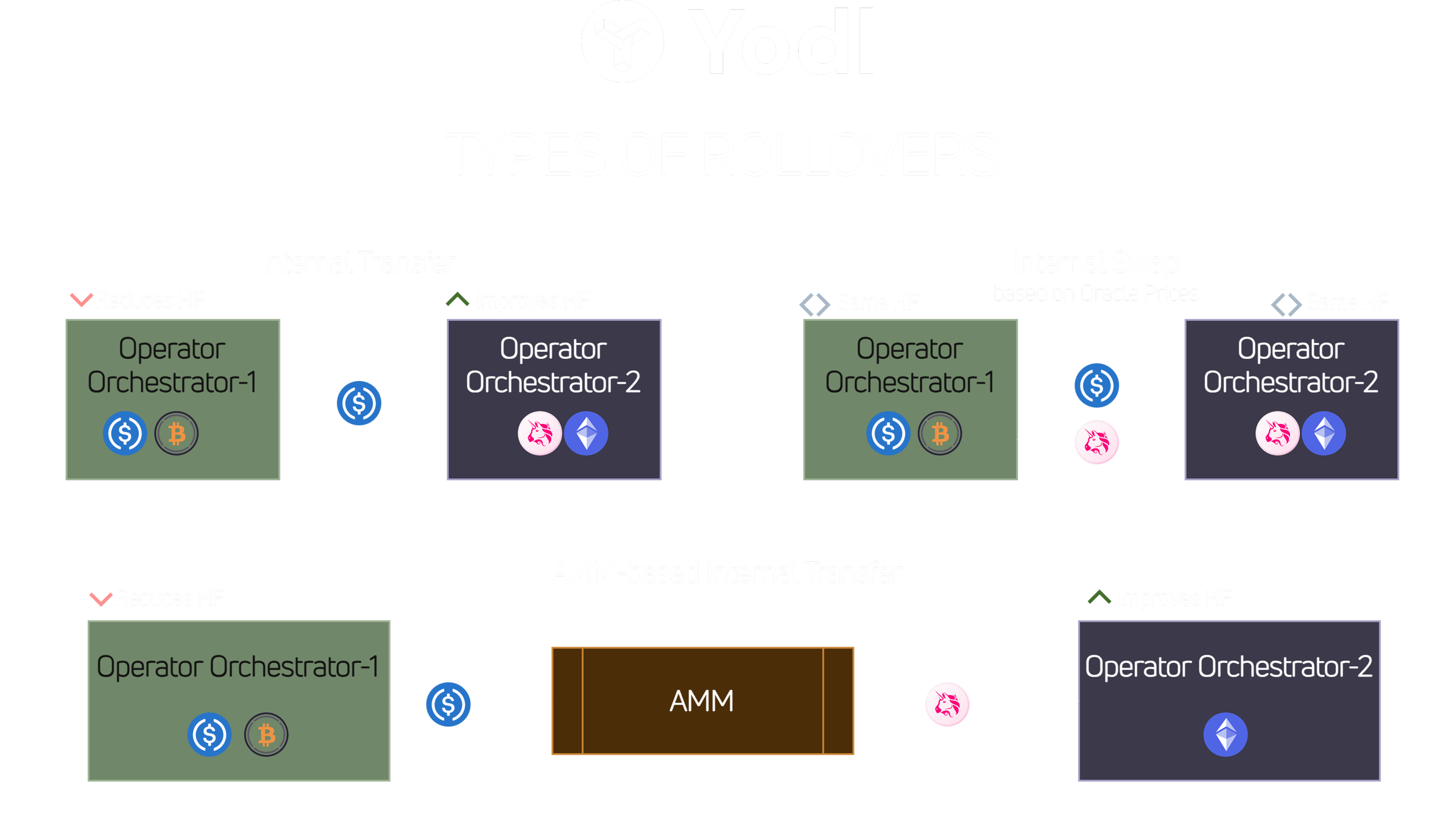

The operator rolls over exposure from one Orchestrator (per-vault) to another (e.g., WETH → USDT) by activating their unused credit capacity (unutilized balances) of the other asset. Rollovers can also be performed within the same asset across Orchestrators for repayments.

Market Execution

The rollover transaction is executed atomically through the Orchestrator using whitelisted AMMs. The Operator incurs standard slippage and taker fees.

Accounting Update

Managing exposure via rollovers may improve HF.

Repayment Obligation

All rollover-borrowed credit must be repaid before the epoch ends; otherwise, it is treated as outstanding exposure requiring restoration through delegated $YODL being slashed under the protocol’s restoration process, which also impacts operator reputation.

Last updated