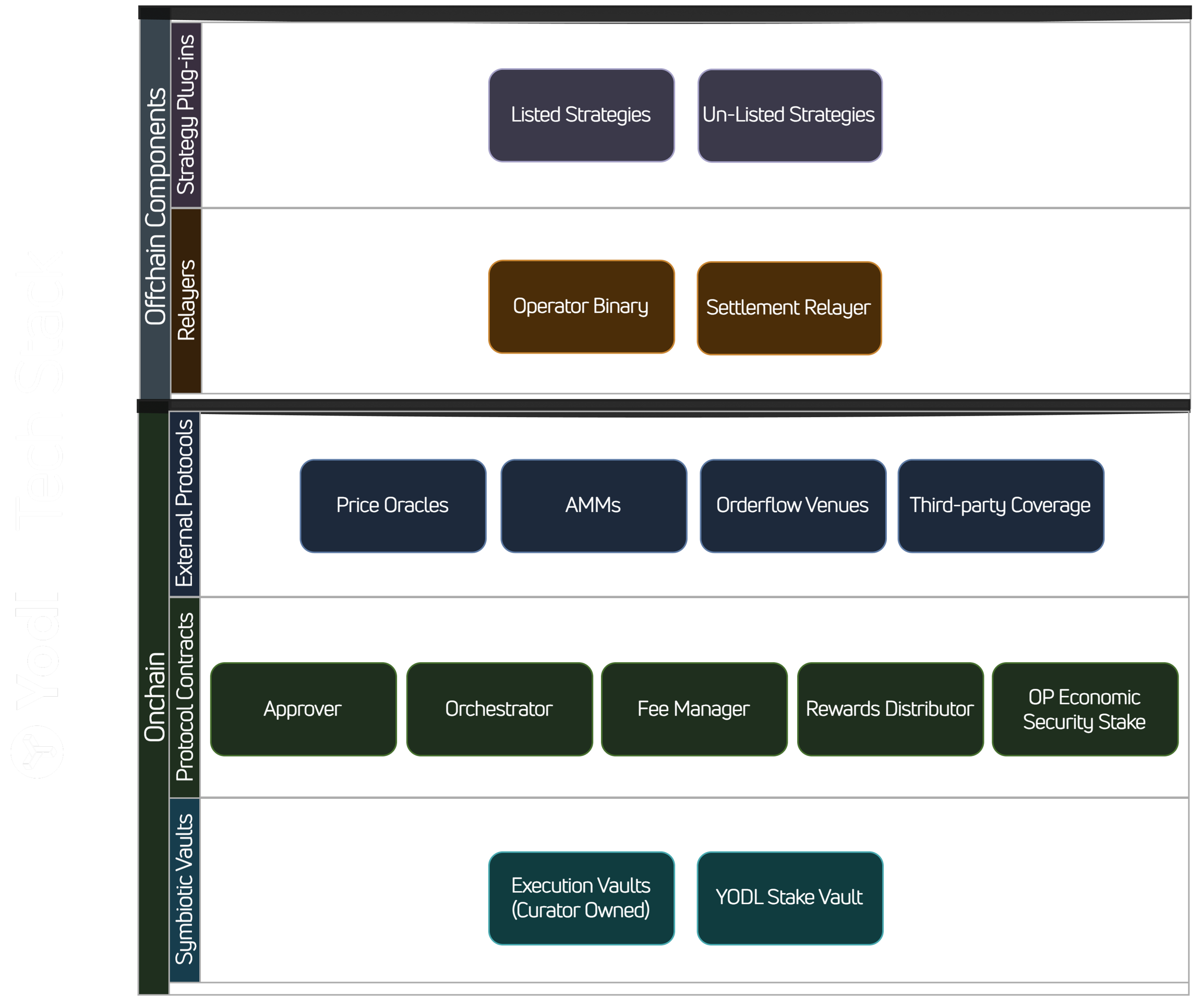

Tech Stack Overview

The YODL architecture is organized into modular layers that together enable trustless strategy execution, deterministic settlement, and full Curator capital protection. Each layer - from strategy plug-ins at the top to Symbiotic vaults at the base - plays a defined role in connecting off-chain execution with verifiable on-chain settlement.

1. Strategy Plug-ins

This top layer defines how trading logic is generated and consumed by Operators.

Listed Strategies — DAO-approved strategies published in the Strategy Marketplace (e.g., CoW Construction Strategy). These strategies follow standardized policy formats and fee-parameter models.

Unlisted Strategies — Privately developed execution logic created by Operators. These integrate directly with the Operator Binary and remain fully proprietary.

Listed and Unlisted strategies operate on equal footing within the execution framework.

2. Off-Chain Components

Execution flow is orchestrated through operator-managed systems:

Operator Binary — The local execution engine responsible for quoting, signing accounting instructions, maintaining exposure neutrality, and interacting with strategy plug-ins.

Settlement Relayer — A policy-enforcing relay layer that standardizes RFQs, applies risk and policy checks, and relays signed transactions to connected orderflow venues.

Together, these components ensure operators execute trades within their permitted permissions and credit limits.

3. External Protocols Integrations

YODL interfaces with external ecosystems to enable accurate pricing, deterministic settlement, and restoration when needed:

Price Oracles — Supply verified pricing for quoting logic and Health Factor calculations.

AMMs — Enable conversions (e.g., taker tokens → vault asset) during finalization and restoration.

Orderflow Venues — Integrations such as 1inch and UniswapX, where Operators supply maker liquidity and receive fee-based compensation.

Third-Party Coverage — Opt-in protection provided by independent partners for institutions requiring additional safeguards.

4. On-Chain Contracts (Control Layer)

This layer enforces credit limits, verifies operator permissions, and performs deterministic settlement.

Approver — Validates operator eligibility, signature scope, metadata correctness, and enforces execution-credit ceilings.

Orchestrator — Per-operator/per-vault smart contract responsible for pre-slashing (if applicable), settlement intake, finalization, and repayment logic.

Fee Manager & Rewards Distributor — Aggregates settlement data and routes fee-shares to Curators, Delegators, and Operators according to protocol-set parameters. The contract does not issue rewards; it deterministically allocates fee-shares from verified fills.

Operator Accountability Stake — Tracks operator-specific stake and enforces slashing for non-performance, solvency failures, or restoration shortfalls.

5. Symbiotic Vaults

The foundation layer where all real capital and all Delegator credit-allocation is recorded:

Execution Vaults (Curator-Owned) — Single-asset vaults that supply the capital used for execution. Each vault is protected by deterministic restoration — all utilized capital must be restored within the epoch.

YODL Stake Vault — Tracks the YODL delegated to each Operator. This delegation determines the Operator’s execution-credit ceiling and provides bounded deficit if restoration is required. Delegated YODL never becomes execution capital; it determines scale and provides restoration.

Last updated